🔥 This offer expires in:

🔥 This offer expires in:

+44 7466 385833

+44 7466 385833

For Everyday 'Savers' Trusting The Banks To Grow Their Wealth

30 Reasons Why Keeping Money In The Bank Is Losing You Money & How To Transform Your Wealth Within 12 Months

Without betting it all on the next big crypto coin, ever needing to talk to a sleazy financial advisor who makes your skin crawl or studying the markets. The Undercover Investor is your comprehensive roadmap to generating consistent returns, no matter what the markets are doing.

4.8 / 5 based on 1,931 reviews

JOE NORRIS

TEACHER & DAD OF 3

I was utterly lost before simply keeping money in bank, odd investment app and paying hidden fees left right and center. I had no idea how the 'systems' truly worked but now it seems so obvious. Getting this full guide was a game changer and I saved the cost of it in one decision, plus now kick started my self education journey so I'm the one in control.

INTRODUCING THE UNDERCOVER INVESTOR

79% of 'Savers' Watch Banks & Inflation Erode Their Wealth* - Get Ahead Today.

Is Your Bank Really Helping You Grow?

Every year, millions of "savers" like you lose money without even knowing it. You deposit your hard-earned cash in a bank, but with annual inflation averaging around 3%, any returns you’re promised are often outpaced by rising costs.

Over time, this invisible loss eats away at your savings—while banks pocket huge profits from lending out your money at rates up to 10x higher than what you’re offered.

This guide reveals an alternative. Instead of watching your money shrink in a traditional bank, learn strategies that allow you to control where your savings go, build real wealth, and finally stop letting the bank profit off your deposits.

It's time to move from passive saver to active investor, with options that don't require Wall Street expertise—just a willingness to step outside the norm.

Avoid a 3% Annual Erosion

Inflation averages around 3% each year, which eats away at savings when returns don’t keep up. This guide reveals strategies that consistently outpace inflation, so you keep what you earn instead of watching it lose value year after year.

Same Access As The Top 1%

Top investors don’t rely on bank accounts. This guide opens up similar opportunities, showing you ways to access high-yield investments typically reserved for the wealthiest 1%, so you can grow wealth like they do without millions to invest.

Banks Lend 5-10X Your Value

You know that number on your bank account screen? Well banks lend 5-10X more than that, making high interest rates as they go and giving you back a pathetic sub 1%. We'll show you how to make your money work for you, not them.

Invest In Under 5 Minutes A Week

Moving away from banks into investment opportunities isn't complicated or scary. even though they will try to make it that way (I wonder why...) - we'll show you how to do that in under 5 minutes per week without the complexity.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your purchase, you'll receive all the links to download of our guide in just a few clicks!

A New System In Investing and Growth...

Here's the course content:

Part 1: Welcome & How To Use This Guide

Part 2: The Hidden Cost of Saving: Why Banks Aren’t Helping You Grow

Part 3: What Inflation Really Means for Your Money

Part 4: The Banking Illusion: How Traditional Saving Hurts You

Part 5: Understanding Compound Growth (And Why You're Missing Out)

Part 6: Meet the New Financial Reality: Why You Must Take Control

How To Make Your Money Work Better For You...

Here's the course content:

Part 7: What The Wealthy Do Differently With Their Money

Part 8: The 3-Bucket System for Smart Money Management

Part 9: How to Build Your Emergency Fund (Without Falling Behind)

Part 10: Foundations of Investing: The Mindset Shift You Need

Part 11: The Building Blocks of Investing (Explained Simply)

Part 12: The Power of Index Funds: Grow Without Guessing

The Financial Freedom Formula...

Here's the course content:

Part 13: What Are ETFs & Why They’re Your Secret Weapon

Part 14: How to Get Started with Just £50–£100

Part 15: Brokerage Accounts: What They Are & How to Open One

Part 16: Investing Strategies Based on Age & Stage of Life

Part 17: The Mistake Most People Make: Chasing Hot Tips

Part 18: Investing vs. Saving: Which One Builds Wealth?

Knowledge Is Power...

Here's the course content:

Part 19: How to Beat Inflation with Smart Investing

Part 20: Understanding Risk: How to Protect Yourself While Investing

Part 21: Time in the Market Beats Timing the Market

Part 22: Passive Income 101: How to Make Your Money Work for You

Part 23: Crypto & High-Risk Investing: Should You Touch It?

Part 24: Automating Your Wealth: Set & Forget Systems

Business Coach: Turn 1h Of Work A Week Into $2,000 A Month...

Here's the course content:

Part 25: How to Avoid Common Investing Traps

Part 26: Your 30-Day Action Plan to Start Investing Today

Part 27: Real Case Studies: Beginner to Investor

Part 28: My Story (Writer's Story)

Part 29: Resources & Tools

Part 30: Conclusion: Your New Financial Future Starts Now

SETUP YOUR INVESTMENT JOURNEY TODAY WITH OUR VALUE BUNDLE FOR JUST $19!

4.8 / 5 based on 1,931 reviews

Exclusive Bonuses Just For YOU!

Along with the Course, get special bonuses that turbocharge your online success. These extras are designed to complement your learning and give you an edge in the digital marketplace. Act now to unlock these invaluable tools!

BONUS 1: Investment Tools Used by the Top 1%

Discover the same powerful tools that wealthy investors rely on to grow and protect their wealth.

BONUS 2: Books the Banks Don’t Want You to Read

A curated list of eye-opening books that reveal financial secrets and strategies to take control of your money)

BONUS 3: Investment Tracking Template

Simplify your investment tracking with a pre-designed template, making it easy to monitor growth, returns, and asset allocation.

BONUS 4: Month Wealth-Building Checklist

Stay on track with a month-by-month action plan, guiding you through your financial transformation over the next year.

BONUS 5: 30 Day Investment Action Plan

Kickstart extra income with quick and easy passive income ideas that fit into any schedule.

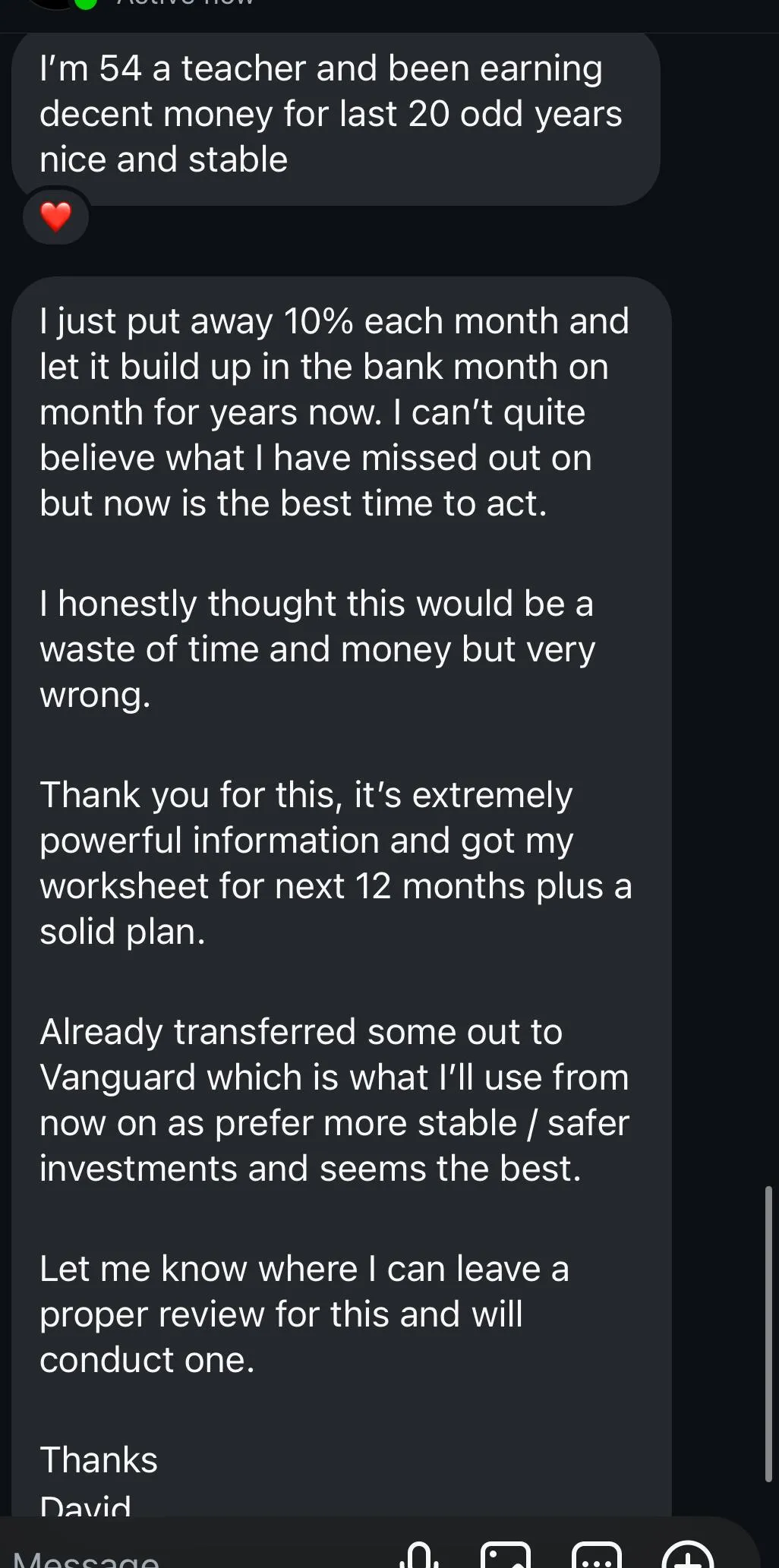

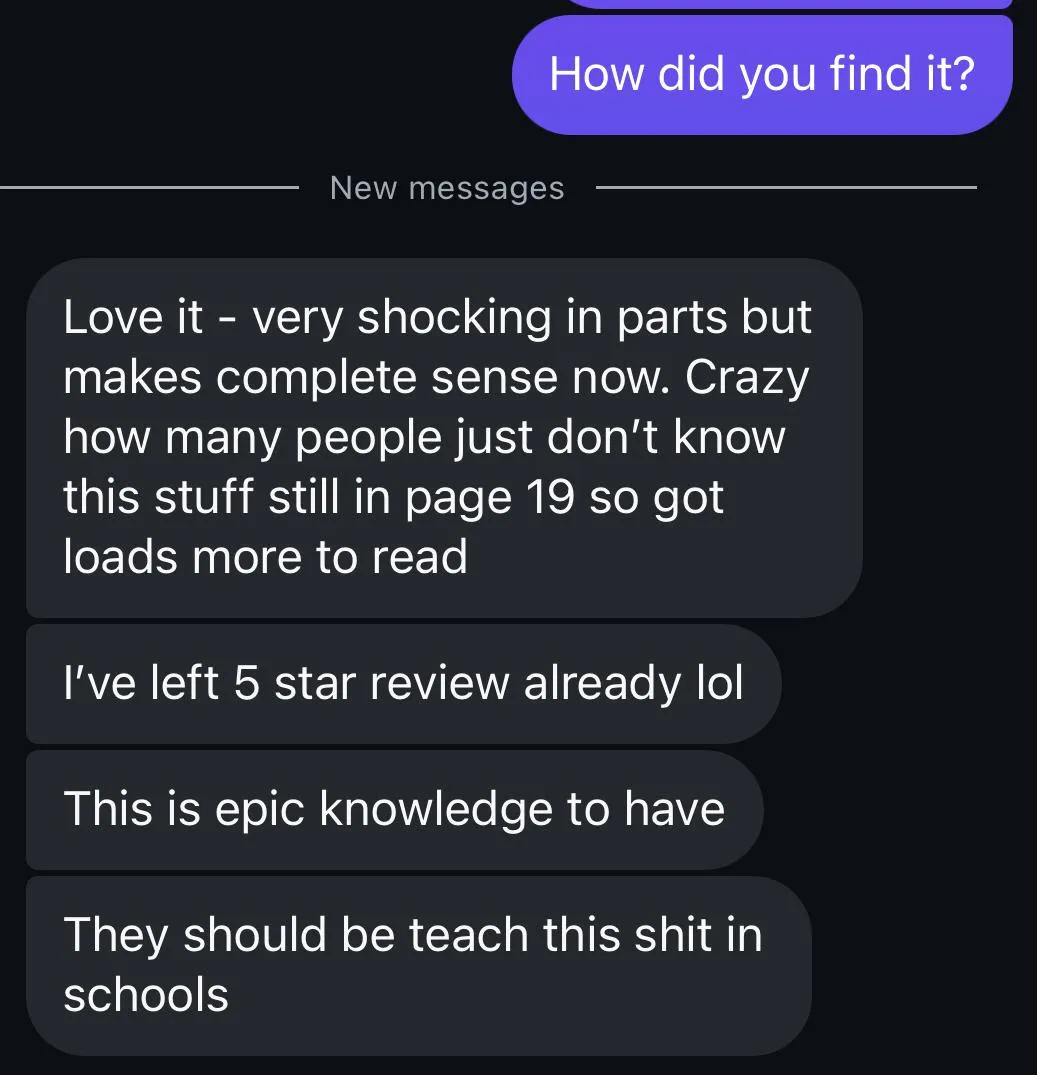

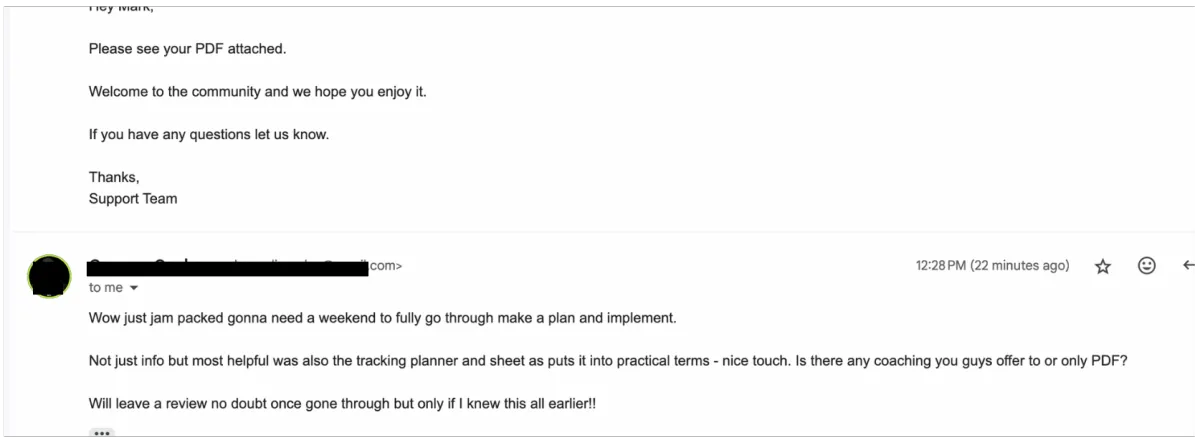

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

SARAH LEWIS

Small Business Owner

"I always thought I was being smart—saving money, paying down debts... but this guide blew my mind. Turns out, there’s way more I could be doing to actually grow what I have. It’s crazy. I’m making moves now that I didn’t even know were possible. Already seeing the benefits, and it’s been worth every cent."

Verified Review

DAVID CHEN

Engineer & Investor

"Always wanted to take charge of my finances but felt like it was just... too much info out there, you know? This guide just lays it all out, step by step. Now my money’s actually working FOR me instead of just sitting in a bank. One month in, I’m already seeing more growth than years of just ‘saving’ ever did."

Verified Review

EMILY REED

Freelancer & mom of 2

"Bank fees, low interest rates... basically, my money was just stagnant. I didn’t even realize how much of a trap I was in till I read this. Just one of the decisions I’ve made from this guide saved me what it cost, honestly. It’s like I finally got control over my own money. Total game-changer."

Verified Review

ROBERT MARTIN

Self-employed entrepreneur

"I used to feel, well... totally clueless about investing and where to start. Then I got this guide, and boom—direction. It’s like having a road map for my money. My biggest regret? Not getting this sooner. Seriously, if you’re looking to break out of that paycheck-to-paycheck cycle, this is it."

Verified Review

JASMINE PATEL

College student & part-time worker

"People always say, ‘Just save your money!’ but no one ever tells you HOW to actually make it grow. This guide changed that. I’m starting small but even now I can see the difference it’s making. For the first time, I’m actually excited about my finances!"

Verified Review

MICHAEL GONZALEZ

Marketing professional

"I’ve been stuck in the traditional banking loop for years, just assuming it was safe and smart. Wrong. This guide opened my eyes. I’m now actually seeing my money do something other than sit there gathering dust. If you’re on the fence, get off it and grab this. It’s already paid for itself, trust me."

Want More? People Just Like You Send Us In This Everyday...

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get The Undercover Investor PDF Today!

With the bundle, you gain immediate access to invaluable resources on how to beat the banks and take control of your financial future. For a limited time, grab this comprehensive package at an unbeatable price. Don’t miss this chance to transform your future and join the top 1%.

UNDERCOVER INVESTOR PDF

$19 USD

VAT/Tax Include

4.8 / 5 based on 1,931 reviews

Full 233 Page Undercover Investor PDF

BONUS 1: Investment Tools Used by the Top 1%

Discover the same powerful tools that wealthy investors rely on to grow and protect their wealth.

BONUS 2: Books the Banks Don’t Want You to Read

A curated list of eye-opening books that reveal financial secrets and strategies to take control of your money.

BONUS 3: Investment Tracking Template

Simplify your investment tracking with a pre-designed template, making it easy to monitor growth, returns, and asset allocation.

BONUS 4: Wealth-Building Checklist

Stay on track with a month-by-month action plan, guiding you through your financial transformation over the next year.

BONUS 5: 30 Day Investment Action Plan

Kickstart extra income with quick and easy passive income ideas that fit into any schedule.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide walks you through why traditional banking may be holding you back financially and introduces proven strategies the wealthy use to grow their wealth. You’ll learn step-by-step how to make smarter financial decisions, set up passive income streams, and protect your money from losing value over time.

Is this guide suitable for beginners?

Absolutely. We’ve designed it for anyone who wants to take control of their finances, whether you’re a complete beginner or have some investment experience. The guide explains everything in clear, simple terms with actionable steps anyone can follow.

Do I need a large amount of money to start?

Not at all! Many of the strategies we share are suitable for any budget. You’ll learn techniques that you can start with a small amount of money and grow over time.

How quickly can I see results?

Some changes, like avoiding hidden banking fees, can bring instant savings, while other wealth-building strategies work over time. With consistent action, you’ll likely see noticeable improvements within the first few months.

Will this guide work for me if I’m already investing?

Yes, definitely. This guide provides insights into strategies used by the top 1% and goes beyond basic investing. You’ll learn methods to enhance your current strategy and uncover areas where you might be losing money without realizing it.

What resources come with the guide?

Along with the main guide, you’ll get a 12-month wealth-building checklist, an Excel investment tracking template, a list of top tools, book recommendations, and easy passive income ideas—all designed to support you in taking action.

How is this different from free advice I can find online?

Great question! This guide brings everything together in one place, with actionable steps and insider strategies that are often scattered across multiple sources. We’ve condensed years of financial wisdom into a single, easy-to-follow guide to save you time and effort.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you save and grow your money—many users report getting more than their money’s worth within days of implementing the tips.

4.8 / 5 based on 1,931 reviews

All rights reserved Finance Hub

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.